child tax credit september 2021 deposit date

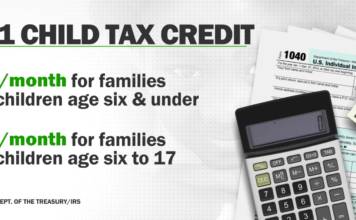

That changes to 3000 for each child ages six through 17. Wait 10 working days from the payment date to contact us.

September Child Tax Credit What To Do If There S A Mistake In Your Payment

This first batch of advance monthly payments worth.

. All payment dates. Eligible taxpayers who dont want to receive advance payment of the 2021 Child Tax Credit will have the opportunity to unenroll from receiving the payments. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of August as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

15 followed by paper checks delivered via mail. 15 opt out by Nov. The Bill Signed Into Law By President Joe Biden Increased The Child Tax Credit From 2000 To Up To 3600 And Allowed Families The Option To Receive 50 Of Their 2021 Child Tax Credit In The Form.

To reconcile advance payments on your 2021 return. December 13 2021 haven t received your payment. Get your advance payments total and number of qualifying children in your online account.

7152021 125213 PM. The IRS is paying 3600 total per child to parents of children up to five years of age. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. Due date for deposit of Tax deductedcollected for the month of June 2022. The IRS will soon allow claimants to adjust their income and custodial.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Child tax credit september 2021 deposit date. Ontario trillium benefit OTB Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment.

The third monthly payment of the enhanced Child Tax Credit is landing in bank accounts on Wednesday providing an influx of cash to millions of families. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. 15 opt out by Aug.

However all sum deductedcollected by an office of the government shall be paid to the credit of the Central Government on the same day where tax is paid without production of an Income-tax Challan. The IRS will pay 3600 total per child to parents of children up to five years of age. 29 What happens with the child tax credit payments after.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. 13 opt out by Aug. September advance child tax credit payments.

Below are the due dates of Income Tax for July 2022. The next child tax credit payment is only one week away and after that only two more checks will be sent this year for November and December. Publication 5534-A 6-2021 Author.

15 opt out by Oct. Likewise if a 17-year-old turns 18. IR-2021-169 August 13 2021.

IR-2021-188 September 15 2021. September 16 2021 735 AM MoneyWatch. 15 opt out by Nov.

Here are the payment dates to keep track of november through december 2021 and in 2022. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. That drops to 3000 for each child ages six through 17.

The deadline for the next payment was november 1. IR-2021-153 July 15 2021. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

For children under 6 the amount jumped to 3600. That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the year not 3600. 2021 Advance Child Tax Credit Payments start July 15 Flyer Created Date.

Kc3E62Nwwh W7M Child Tax Credit Payments Are Over But You Could Still Get 1800 In 2022 The Irs Disbursed The Final Child Tax Credit Payment Of 2021 On. This third batch of advance monthly payments totaling about 15 billion is reaching about 35. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September.

Enter your information on Schedule 8812 Form. October 5 2022 Havent received your payment.

When Is The Next Child Tax Credit Payment

October Child Tax Credits Issued Irs Gives Update On Payment Delays

Child Tax Credit Irs Unveils Address Change Feature For September Payment

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Child Tax Credit Delayed How To Track Your November Payment Marca

The Big Increase And More Changes To The Child Tax Credit In 2021

Canadian Tax News And Covid 19 Updates Archive

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Child Tax Credit 2021 How To Track September Next Payment Marca

Child Tax Credit 2021 8 Things You Need To Know District Capital

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

Odsp Payment Dates 2022 When Do You Get Your Disability Benefits

Canada Child Benefit Payments The Benefits

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com